Investor Relations

| Elia Group | Elia Transmission Belgium | ||||||

| Annual report 2023 | EN | FR | NL | EN | FR | NL | |

| Press release full-year results 2023 | EN | FR | NL | - | |||

| Full-year results 2023: presentation | EN |

- | |||||

| Webcast: Full-year results 2023 | View webcast | - | |||||

| Transcript: Full-year results 2023 | EN | - | |||||

| Capital Markets Day 2023: presentation | EN |

- |

|||||

| Webcast: Capital Markets Day 2023 | View webcast | - | |||||

| Transcript: Capital Markets Day 2023 | EN | - | |||||

| See all reports | See all reports | ||||||

More reports: 50Hertz Elia Grid international re.alto

Full-year results 2023

“In 2023, crucial steps were taken in the implementation of our strategy, marked by a tangible acceleration. Many of our projects anticipate the rapid rise of electrification. Both in Belgium and Germany, we worked on an upgrade of the federal grid development plan and negotiated a new regulatory framework. This strengthens our organic growth and provides the means to achieve the increased investment plan of €30.1 billion. Additionally, our first partnership in the US marks a significant step shaping the future of the Elia Group. Our non-regulated activities have the potential to enhance our relevance and push forward the Group’s growth. All of this makes it clear that 2023 brought us to a point of no returning.”

Catherine Vandenborre, CEO Elia Group ad interim

Financial calendar

Capital Markets Day 2023

Companies within Elia Group

Why invest in Elia Group ?

Focused on sustainable value creation and with our unique know-how Elia Group enhances its core business to be more resilient and decrease its risk exposure through diversification. We focus on creating long-term value and building a healthy company that responds to the opportunities brought about by the energy transition, by bringing them to our shareholders in a relevant way.

1

Reliable, sustainable TSOs

|

2

Regulated predictable earnings

|

3

Strong organic growth

|

4

Forefront of the energy transition

|

5

Attractive shareholder return

|

Our focus on sustainability

We are enabling the energy transition by developing diversified, sustainable and reliable on- and offshore electricity system.

No results found

-

10 January 2024

Elia Transmission Belgium successfully places second €800 million Green Bond

Elia Transmission Belgium (“ETB”) has successfully placed a €800 million green bond under its €6 billion Euro Medium Term Notes (“EMTN”) programme, to be listed on the Euro MTF market operated by the Luxembourg Stock Exchange. -

13 November 2023

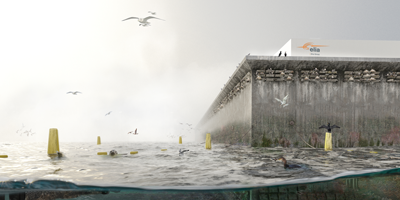

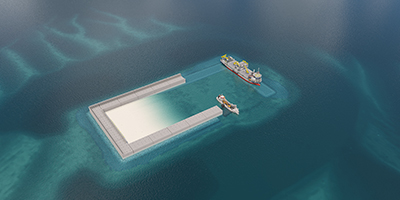

Elia takes seven tangible measures to enhance biodiversity around the Princess Elisabeth Island

System operator Elia wants to boost biodiversity around the future energy island in the North Sea. -

03 October 2023

Environmental permit awarded for Princess Elisabeth Island, a key link in our future energy supply

Construction of the Belgian energy island will start early next year. North Sea Minister Vincent Van Quickenborne has approved the relevant environmental permit. -

15 June 2023

Elia and Ecofirst share their experience in managing ecological corridors under high-voltage lines

On 14 and 15 June, electricity transmission system operator (TSO) Elia took part in a workshop organised by the European NGO RGI (Renewables Grid Initiative) on the development of ecological corridors under high-voltage lines. -

15 February 2023

Elia Group is one of 20 companies to join the new BEL®ESG stock market index

Elia Group is one of the Belgian companies selected to be part of BEL®ESG, the new stock market index directly linked to sustainability launched today by Euronext. -

12 January 2023

Elia Transmission Belgium has successfully placed its inaugural €500 million Green Bond

Elia Transmission Belgium has successfully placed a €500 million Green Bond under its €3 billion Euro Medium Term Notes (“EMTN”) programme to be listed on the Euro MTF of the Luxembourg Stock Exchange. -

03 October 2022

Elia presents its plans for an energy island, which will be called the Princess Elisabeth Island

In the presence of federal ministers Tinne Van der Straeten (Energy) and Vincent Van Quickenborne (North Sea), system operator Elia has presented its draft plans for what will be the world’s first artificial energy island. -

27 September 2022

A first in Belgium: Elia deploys drones to install bird diverters on its high-voltage lines

Today, Elia is installing bird diverters using drones – a first in Belgium. -

22 February 2022

Elia Group expands its international offshore activities through its new subsidiary WindGrid

Elia Group's Board of Directors has approved the formation of a new subsidiary. Through WindGrid, Elia Group is ready to meet offshore development needs. -

11 February 2022

Elia Group’s sixth Open Innovation Challenge is focused on sustainability

The annual Open Innovation Challenge (OIC) allows Elia Group to maintain close ties with a broad ecosystem of start-ups and small and medium-sized enterprises (SMEs). -

22 December 2021

Elia Transmission Belgium publishes its first Green Finance Framework, aligning its funding strategy with its objective to accelerate the energy transition

In line with Elia Group’s role as an enabler of the energy transition, Elia Transmission Belgium (ETB) - Elia Group’s Belgian subsidiary - has published its first ever Green Finance Framework. -

17 December 2021

Installation of markers on high-voltage lines leads to 75% fewer bird collisions

Installing markers on high-voltage lines leads to a sharp drop in the number of bird collisions, according to a Natuurpunt study commissioned by Elia. -

18 October 2021

Green Bid wins Elia Group’s first ever hackathon on energy services for consumers with solution that allows prosumers to sell their excess solar energy

BRUSSELS -From 13 to 15 October, Elia Group hosted its first ever hackathon, which aimed to translate the Group’s vision on consumer centricity into tangible, practical solutions. -

22 September 2021

Elia makes overhead line by Eau d’Heure lakes more visible to birds

Bird markers help birds see the overhead line better so they don't collide with it. Elia, the operator of the Belgian high-voltage transmission grid, installed bird markers following a study that identified those lines in Belgium that are potentially the most dangerous to birds. -

04 June 2021

Elia Group presents its sustainability action plan: ACT NOW

In recent years, sustainability has become a core part of Elia Group's strategy. Our ACT NOW plan defines concrete and measurable objectives which outline how we will embed sustainability into our business processes in the years ahead. -

14 May 2021

Thirty companies selected for second round of tests in IO.Energy ecosystem to work on new energy services

Some 30 companies from various industries will test out new energy services as part of the Internet of Energy (IO.Energy). -

01 April 2021

Elia makes overhead line in Ghent Canal Zone visible to birds

Bird markers have been installed on the overhead line by the R4 road in Evergem to ensure birds can see it better and collide with it less often. -

30 January 2021

Elia upgrades north-south axis of Belgian high-voltage grid between Kruibeke and Dilbeek

Elia, the Belgian high-voltage grid operator, is upgrading the north-south axis of the Belgian electricity grid

between the Mercator and Bruegel high-voltage stations in Kruibeke and Dilbeek, respectively. -

26 January 2021

Be Planet and Elia join forces to support sustainable development in eastern Liège Province

Following on from last June's call for projects from private individuals and associations, the Be Planet foundation and Elia today presented the 13 projects that will benefit from the community support fund in connection with the second phase of the East Loop (‘Boucle de l’Est’) project. -

14 January 2021

Elia Group’s fifth Open Innovation Challenge focuses on innovative solutions for offshore wind applications

Elia Group, a European Group of transmission system operators active in Belgium (Elia) and northeast Germany (50Hertz), is set to launch its fifth Open Innovation Challenge. -

18 December 2020

10 leading TSOs launch joint initiative to reduce GHG emissions

This GHG reduction effort will tackle their own carbon footprint while also addressing much greater opportunities at system level, driven by electrification and the integration of renewable electricity sources (RES). The joint initiative is supported by Amprion (DEU), APG (AUT), Elia Group (BE & DEU), Red Eléctrica (ES), RTE (FR), Swissgrid (CH), Tennet (NL & DEU) and Terna (IT). -

09 October 2020

IO.Energy ecosystem enters its second phase and plans to test new energy services

The first sandboxing phase of the Internet of Energy (IO.Energy) project came to an end on Friday 9 October and was marked by an event attended by Thomas Dermine, the new State Secretary for Scientific Policy, Recovery and Strategic Investments. -

03 July 2020

Five Elia Group innovation competition finalists announced

Five finalists from different parts of the world are still in the running for the fourth Open Innovation Challenge. The contest is a joint initiative by Belgian system operator Elia and its German sister company 50Hertz. The Open Innovation Challenge helps Elia Group to innovate in highly specific areas of its work as a system operator by engaging in joint projects with start-ups. -

29 May 2020

Last offshore wind farm successfully connected to North Sea power hub

The connection of the Seastar wind farm marks the completion of the Modular Offshore Grid (MOG), Elia’s offshore power hub. Located 40 km off the Belgian coast, the switching platform bundles together the export cables from four offshore wind farms and transports the generated energy to the mainland via a shared transmission system

Towards a more sustainable world